Business Incorporation Services Calgary

Our business incorporation services in Calgary help entrepreneurs launch and structure their companies for long-term success. We handle federal and provincial registration, articles of incorporation, and initial CRA business account setup. Our business incorporation experts in Calgary guide you through every step of starting your business.

CRA compliant process. Trusted nationwide.

Tax Return Filers LTD Delivers Strategic Tax Solutions in Calgary

Clients trust our proven approach. Each financial situation receives a custom tax strategy supported by deep expertise and attention to detail. Our 100% five star ratings across verified reviews reflect consistent client satisfaction and on time filings.

Trusted by 1,000+ Canadians

CPA Certified

QuickBooks

Certified Partner

Why Hire a Business Incorporation Expert in Calgary?

Hiring a business incorporation expert in Calgary ensures your new company starts with the correct legal structure and tax framework. Many entrepreneurs attempt self-registration but miss critical steps like share structure optimization, minute book preparation, or proper industry-specific classification. These oversights can limit your future growth, complicate tax filings, and prevent income retention and income splitting opportunities down the road.

Starting a small business involves more than just a name search. You need a structure that protects your personal assets and supports your operational goals.

When you choose Tax Return Filers for business incorporation in Calgary, you gain a partner who understands both legal requirements and tax implications. We handle your business registration in Calgary with precision, setting up your articles of incorporation, share classes, and initial corporate records. Our team provides training and support on maintaining your minute book and meeting annual filing requirements.

Solutions For Businesses

Our Calgary accounting services cover tax preparation, bookkeeping, payroll, financial statements, audit and assurance, estate planning, and business incorporation.

Choosing the Right Business Structure in Ontario

Selecting the right business structure determines your tax obligations, personal liability exposure, and administrative requirements for years ahead. Our accounting firm in Calgary analyzes your goals and recommends the structure that delivers maximum benefit for your situation.

Business Structure Options

- Federal Corporation under the Canada Business Corporations Act for businesses operating across provinces

- Alberta Provincial Corporation under the ABCA for companies focused on local operations

- Professional Corporation for regulated professionals including doctors, dentists, lawyers, and accountants

- Non-Profit Corporation for charities and community organizations

- Numbered Company for entrepreneurs who want fast registration without a name search

- Partnership or Joint Venture for businesses with multiple owners sharing profits and responsibilities

What We Consider:

Each structure carries different implications for taxation, liability protection, and ongoing compliance. Federal incorporation provides nationwide name protection and expansion flexibility, while provincial incorporation offers administrative simplicity for Alberta-focused businesses.

Business Registration and Document Preparation in Calgary

Our Calgary team prepares essential corporate documents to establish your legal structure and governance. We ensure your business launches with comprehensive records that satisfy regulatory requirements.

Ongoing Compliance and Corporate Calgary

We offer dedicated maintenance services to handle changes and updates as your business evolves. Our team ensures your corporate records reflect your current operational structure.

Expert Business Incorporation Services Calgary

Entrepreneurs across Calgary’s business landscape trust our firm for expert business incorporation services that establish strong foundations for success. We guide startups and growing businesses through federal and provincial incorporation to ensure proper structure selection, accurate filings, and complete documentation from day one.

Our Chartered Professional Accountants handle NUANS searches, articles of incorporation, corporate bylaws, CRA registrations, and minute book setup under one roof. Clients receive ongoing compliance support that keeps their corporation in good standing and positions them for growth across Alberta and beyond. We consider your future financing needs, potential partnerships, and exit strategies when we set up your corporation to maximize income retention and tax efficiency.

Why Choose Tax Return Filers Ltd ?

Our team combines advanced academic credentials with decades of practical experience to deliver exceptional tax solutions tailored to your needs.

CRA-Compliant Experts

Our team includes CPA, ACCA, PhD-qualified professionals with specializations in cross-border, corporate, and personal taxation.

CRA Audit Defense

Successfully handled numerous CRA audits with expertise in Foreign Tax Credits, Section 216/116, and complex tax matters.

Strategic Tax Planning

We don’t just file returns, we develop proactive strategies to minimize your tax burden and maximize your financial outcomes.

Trusted Nationwide

With offices in the Greater Toronto Area and Calgary, we provide expert tax services to clients across Canada confidently.

Our Calgary Office

Our CPA firm is located in Calgary and serves clients across the Alberta. We provide in-person meetings at our office and virtual consultations.

Address

50 Nolanridge Ct NW Unit 225, Calgary, AB T3R 2A8, Canada

Phone

Customers Reviews

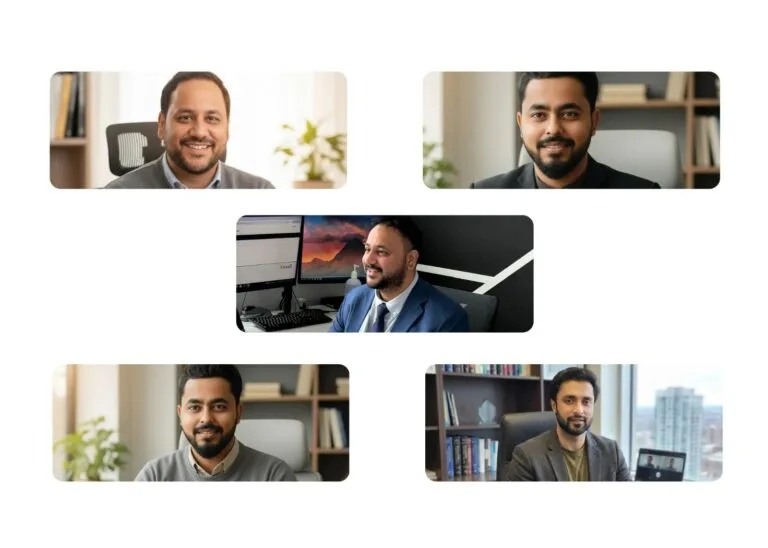

Meet Our Tax Professionals

Our team includes Chartered Professional Accountant and licensed CPA with years of hands-on experience. We track every tax law change to provide accurate guidance for individuals and businesses.

Waqar Naqvi, Ph.D., MFin, CFA

Tax Consultant

Narinder Singh, CPA, CGA

Head of Tax Planning, Corporate Structuring, and Corporate Taxes (T2)

Umar Khan, ACCA

Head of Bookkeeping US & Canada, Payroll, and HST

Got Any Questions?

Book a Free Meeting with Our Tax Experts

Take the first step toward better tax planning with a free consultation. Our team is ready to review your situation and provide clear guidance. Book a time slot directly on our calendar and we will connect with you shortly.