Certificate of Compliance Service in Calgary

Our certificate of compliance service in Calgary helps property sellers and non-residents obtain CRA clearance before completing real estate transactions. We handle Form T2062 filing, Section 116 compliance, and certificate of compliance applications for non-residents across Alberta.

CRA compliant process. Trusted nationwide.

Tax Return Filers LTD Delivers Strategic Tax Solutions in Calgary

Clients trust our proven approach. Each financial situation receives a custom tax strategy supported by deep expertise and attention to detail. Our 100% five star ratings across verified reviews reflect consistent client satisfaction and on time filings.

Trusted by 1,000+ Canadians

CPA Certified

QuickBooks

Certified Partner

Why Choose Our Certificate of Compliance Service in Calgary?

Obtaining a certificate of compliance from CRA requires precise documentation, accurate tax calculations, and timely submission. Many property sellers and non-residents face delays, penalties. Our CoC service in Calgary eliminates these risks by managing every step of the process from initial assessment to final CRA approval.

Non-residents who sell Canadian property must comply with Section 116 requirements before the transaction closes. Failure to obtain a certificate of compliance results in the buyer withholding 25% or more of the sale price. Our team prepares Form T2062 filings with accurate cost base calculations, capital gains assessments, and supporting documentation that CRA demands.

When you choose Tax Return Filers for certificate of compliance in Calgary, you gain a dedicated team that communicates directly with CRA on your behalf. We track application status, respond to CRA inquiries, and resolve issues before they delay your closing. Calgary property sellers and non-resident investors trust our CPAs to secure clearance certificates efficiently and protect their sale proceeds across Alberta.

Solutions for Non-Residents

Specialized tax services for individuals with Canadian income, property, or cross-border obligations.

Complete Certificate of Compliance Services in Calgary

Our Calgary accounting firm delivers complete CRA certificate of compliance for non-residents disposing of Canadian real estate and taxable Canadian property. We manage every step from initial consultation to final certificate issuance and ensure your property transaction closes without holdups.

Our expert Chartered Accountants prepare Form T2062 for real estate sales and Form T2062A for other taxable Canadian property dispositions. We calculate your adjusted cost base, determine capital gains, apply treaty benefits, and submit accurate applications to CRA. Every filing includes supporting documentation that accelerates approval and prevents CRA rejections.

Non-resident sellers receive guidance on the 25%-50% withholding requirement and strategies to reduce funds held in trust. We analyze your situation to identify exemptions, deductions, and treaty provisions that lower your tax liability.

After your sale completes, we prepare your Section 116 return to report the final disposition and claim any refund owed from excess withholding. Calgary property sellers and non-resident investors trust our CoC service in Calgary for efficient processing and maximum retention of their sale proceeds.

Related Services:

01.

Form T2062 Preparation and Filing

02.

Form T2062A for Taxable Canadian Property

03.

Section 116 Non-Resident Disposition Returns

04.

Capital Gains Tax Calculations for Non-Residents

05.

Tax Treaty Benefit Applications

06.

CRA Withholding Tax Recovery

07.

Non-Resident Real Estate Tax Advisory

08.

Clearance Certificate Expediting

Form T2062 Filing Service Calgary

Form T2062 notifies CRA that a non-resident is disposing of Canadian real estate and requests a Certificate of Compliance. Our Calgary filing service handles this mandatory requirement for property sellers residing outside Canada. We gather your purchase agreement, closing documents, renovation receipts, and legal expenses to build a complete submission package that meets CRA standards on the first attempt.

Delayed or incomplete T2062 filings result in held funds and complicated closings. Our Chartered Professional Accountants verify every calculation, submit your application promptly, and monitor progress until CRA releases your certificate to the lawyer handling your transaction. Calgary property sellers trust our Form T2062 filing service to secure timely clearance and protect their sale proceeds across Alberta.

Why Choose Tax Return Filers Ltd ?

Our team combines advanced academic credentials with decades of practical experience to deliver exceptional tax solutions tailored to your needs.

CRA-Compliant Experts

Our team includes CPA, ACCA, PhD-qualified professionals with specializations in cross-border, corporate, and personal taxation.

CRA Audit Defense

Successfully handled numerous CRA audits with expertise in Foreign Tax Credits, Section 216/116, and complex tax matters.

Strategic Tax Planning

We don’t just file returns, we develop proactive strategies to minimize your tax burden and maximize your financial outcomes.

Trusted Nationwide

With offices in the Greater Toronto Area and Calgary, we provide expert tax services to clients across Canada confidently.

Our Calgary Office

Our CPA firm is located in Calgary and serves clients across the Alberta. We provide in-person meetings at our office and virtual consultations.

Address

50 Nolanridge Ct NW Unit 225, Calgary, AB T3R 2A8, Canada

Phone

Customers Reviews

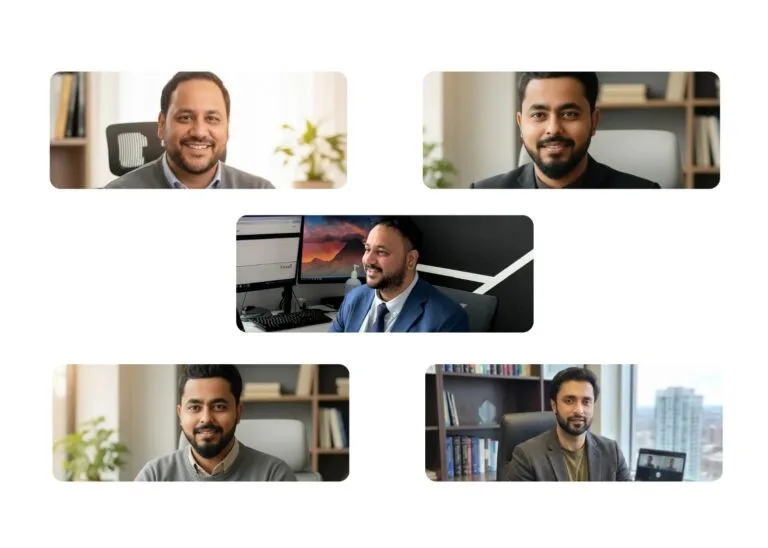

Meet Our Tax Professionals

Our team includes Chartered Professional Accountant and licensed CPA with years of hands-on experience. We track every tax law change to provide accurate guidance for individuals and businesses.

Waqar Naqvi, Ph.D., MFin, CFA

Tax Consultant

Narinder Singh, CPA, CGA

Head of Tax Planning, Corporate Structuring, and Corporate Taxes (T2)

Umar Khan, ACCA

Head of Bookkeeping US & Canada, Payroll, and HST

Got Any Questions?

Book a Free Meeting with Our Tax Experts

Take the first step toward better tax planning with a free consultation. Our team is ready to review your situation and provide clear guidance. Book a time slot directly on our calendar and we will connect with you shortly.