Departure Tax Return Filing Service in Calgary

Our departure tax return filing service in Calgary helps individuals who are leaving Canada meet their final tax obligations. We handle deemed disposition calculations, tax residency determinations, and all CRA filing requirements for emigrants. Our departure tax accountants in Calgary ensure you remain compliant while minimizing your tax liability before you relocate internationally.

CRA compliant process. Trusted nationwide.

Tax Return Filers LTD Delivers Strategic Tax Solutions in Calgary

Clients trust our proven approach. Each financial situation receives a custom tax strategy supported by deep expertise and attention to detail. Our 100% five star ratings across verified reviews reflect consistent client satisfaction and on time filings.

Trusted by 1,000+ Canadians

CPA Certified

QuickBooks

Certified Partner

Why Hire a Departure Tax Accountant in Calgary?

Hiring a departure tax accountant in Calgary protects you from costly mistakes during one of the most complex tax situations you will face. When you leave Canada, CRA treats you as having sold all your assets at fair market value on your departure date, triggering potential capital gains on investments, real estate, and retirement accounts.

Canada exit planning and Departure tax returns in Calgary demand precise timing and strategic planning. Filing errors result in unexpected tax bills, double taxation in your new country, and potential CRA audits that follow you abroad. Many emigrants also miss opportunities to defer taxes on certain properties and claim exemptions that reduce their final Canadian tax burden.

When you choose Tax Return Filers, you gain a team that specializes in international departure tax returns and moving out of Canada tax filing. We assess your complete financial situation, identify assets subject to deemed disposition, and apply all available exemptions under Canadian tax law. Our departure tax accountants in Calgary coordinate with your destination country’s requirements to prevent double taxation and ensure a smooth transition.

Immigrants who previously moved to Canada and are now relocating also receive specialized support for their unique filing circumstances.

Solutions for Non-Residents

Specialized tax services for individuals with Canadian income, property, or cross-border obligations.

Complete Departure Tax Services in Calgary

Canadians with complex holdings need specialized support when filing departure taxes and leaving Canada. We work with clients holding investment portfolios, private corporation shares, stock options, foreign assets, and Canadian rental properties to ensure accurate reporting across all asset categories.

Our Chartered Professional Accountants determine fair market value for each holding on your departure date. We apply principal residence exemptions, calculate adjusted cost bases, and identify treaty provisions that reduce your Canadian tax liability. Our departure tax accountants in Calgary review your complete financial picture to uncover every available deduction and exemption.

Clients receive a complete departure tax and Canada exit planning package ready for CRA submission. This includes your final T1 return, all required schedules, and supporting documentation that substantiates every valuation and calculation we prepare. We ensure your international departure tax return meets CRA standards on the first submission.

Moving Out Of Canada Tax Filing Service in Calgary

Relocating abroad permanently requires careful tax planning before you leave Canadian soil. Our accounting firm in Calgary delivers complete moving out of Canada tax filing services that address every CRA requirement for departing residents.

Emigrating from Canada triggers deemed disposition rules on most assets you own. Our Chartered Professional Accountants determine your departure date, establish your tax residency status, identify taxable properties, and calculate capital gains on investments, rental properties, and business holdings. We claim all eligible deductions on your final return and apply exemptions that reduce your overall tax burden.

Our emigration tax services include preparation of Form T1161 for asset reporting, Form T1243 for departure tax deferral elections, and Form NR73 for residency status determination. We advise on RRSP withdrawals, TFSA treatment, and ongoing Canadian income sources that require future filings. Immigrants who previously relocated to Canada and are now leaving also receive tailored support for their unique circumstances.

Why Choose Tax Return Filers Ltd ?

Our team combines advanced academic credentials with decades of practical experience to deliver exceptional tax solutions tailored to your needs.

CRA-Compliant Experts

Our team includes CPA, ACCA, PhD-qualified professionals with specializations in cross-border, corporate, and personal taxation.

CRA Audit Defense

Successfully handled numerous CRA audits with expertise in Foreign Tax Credits, Section 216/116, and complex tax matters.

Strategic Tax Planning

We don’t just file returns, we develop proactive strategies to minimize your tax burden and maximize your financial outcomes.

Trusted Nationwide

With offices in the Greater Toronto Area and Calgary, we provide expert tax services to clients across Canada confidently.

Our Calgary Office

Our CPA firm is located in Calgary and serves clients across the Alberta. We provide in-person meetings at our office and virtual consultations.

Address

50 Nolanridge Ct NW Unit 225, Calgary, AB T3R 2A8, Canada

Phone

Customers Reviews

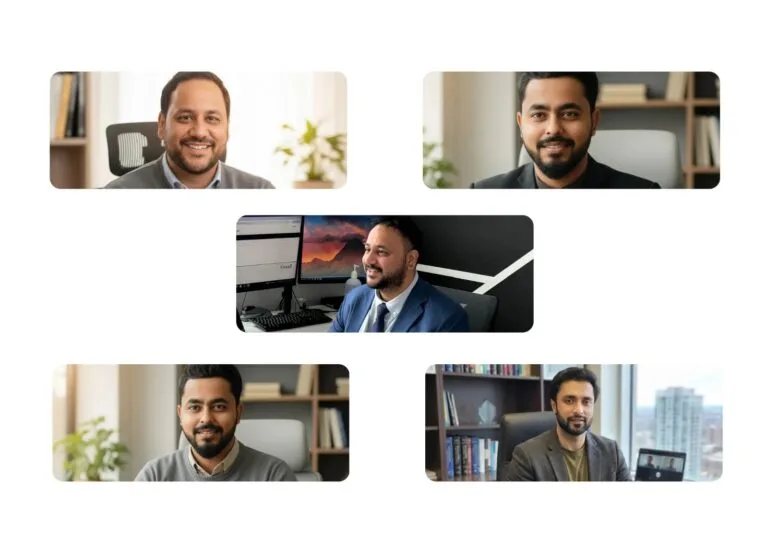

Meet Our Tax Professionals

Our team includes Chartered Professional Accountant and licensed CPA with years of hands-on experience. We track every tax law change to provide accurate guidance for individuals and businesses.

Waqar Naqvi, Ph.D., MFin, CFA

Tax Consultant

Narinder Singh, CPA, CGA

Head of Tax Planning, Corporate Structuring, and Corporate Taxes (T2)

Umar Khan, ACCA

Head of Bookkeeping US & Canada, Payroll, and HST

Got Any Questions?

Book a Free Meeting with Our Tax Experts

Take the first step toward better tax planning with a free consultation. Our team is ready to review your situation and provide clear guidance. Book a time slot directly on our calendar and we will connect with you shortly.