Real Estate Tax Filing in Calgary

Our real estate tax filing in Calgary helps property owners, investors, and developers navigate complex tax obligations. We handle rental income reporting, capital gains calculations, principal residence exemptions, and Section 45 elections for properties across Alberta. Our Calgary real estate tax accountants ensure accurate filings that minimize your tax liability while maintaining full CRA compliance.

CRA compliant process. Trusted nationwide.

Tax Return Filers LTD Delivers Strategic Tax Solutions in Calgary

Clients trust our proven approach. Each financial situation receives a custom tax strategy supported by deep expertise and attention to detail. Our 100% five star ratings across verified reviews reflect consistent client satisfaction and on time filings.

Trusted by 1,000+ Canadians

CPA Certified

QuickBooks

Certified Partner

Why Hire a Real Estate Accountant in Calgary?

Hiring a real estate accountant in Calgary protects your property investments from costly tax mistakes and missed deductions. Real estate taxation involves complex rules around capital versus current expenses, depreciation claims, and change of use elections.

Many investors overpay taxes on rental income because they fail to claim eligible expenses like mortgage interest, repairs, and property management fees. Others face unexpected tax bills upon sale due to incorrect capital gains reporting or missed principal residence exemptions. Without expert guidance, your real estate portfolio may become a tax liability rather than an asset.

When you choose Tax Return Filers for real estate tax filing Calgary, you gain a dedicated team that understands the property market. We analyze your portfolio, prepare rental schedules, and file elections that defer or reduce taxes. Our real estate tax accountants in Calgary support landlords, flippers, and developers with strategies tailored to their specific goals.

Compete Real Estate Tax Services in Calgary

Our real estate tax services in Calgary cover every tax obligation for property owners, investors, and developers. We handle corporate structuring, rental income reporting, capital gains management, and full CRA compliance for all real estate transactions.

Corporate tax planning for real estate investors includes segregation of passive and active income streams to manage high tax rates on investment earnings. Our Chartered Professional Accountants establish holding company structures for asset protection, organize property ownership for tax optimization, and ensure qualification for small business deductions that lower taxable income. We prepare T2 corporate tax returns and manage payroll strategies to optimize your overall tax position.

Rental property owners receive support for GST New Residential Rental Property Rebate applications and GST New Housing Rebate claims. Since Alberta operates under the GST system, we focus on maximizing your federal recoveries. We calculate capital gains on Schedule 3 with strategies that minimize tax liabilities. Non-resident property owners benefit from our expertise in reducing the 25% withholding tax through proper Section 216 elections and treaty claims.

Our Calgary accounting firm maintains accurate depreciation (CCA) tracking for tax savings and provides expert bookkeeping for property-related expenses including maintenance, improvements, and mortgage interest. Every filing meets CRA regulations, tracks substantially renovated property sales correctly, and claims all available deductions.

Tax Compliance for Property Flippers and Developers

Property flipping and development activities face strict CRA scrutiny because profits may be classified as business income rather than capital gains. Our Calgary real estate tax accountants ensure proper income classification, accurate expense tracking, and full compliance with HST obligations on substantially renovated properties.

We prepare filings that withstand CRA review and document your transactions with supporting records that justify your tax position. Our team tracks construction costs, land acquisition expenses, and financing charges to maximize deductions while meeting all reporting requirements for flips and development projects.

Real Estate Tax Planning for Property Investors in Calgary

Strategic tax planning reduces your overall tax burden and increases returns on every property investment. Our Calgary real estate tax accountants analyze your portfolio and develop customized strategies for property acquisition, ownership structuring, and eventual disposition.

We advise on holding company formation, income splitting opportunities, capital cost allowance (CCA) claims, and timing of property sales for optimal tax treatment. Our real estate tax planning in Calgary includes analysis of principal residence exemptions, change of use rules, and deferral strategies. Investors receive year-round guidance that adapts to changing tax laws and evolving investment goals across Alberta.

Why Choose Tax Return Filers Ltd ?

Our team combines advanced academic credentials with decades of practical experience to deliver exceptional tax solutions tailored to your needs.

CRA-Compliant Experts

Our team includes CPA, ACCA, PhD-qualified professionals with specializations in cross-border, corporate, and personal taxation.

CRA Audit Defense

Successfully handled numerous CRA audits with expertise in Foreign Tax Credits, Section 216/116, and complex tax matters.

Strategic Tax Planning

We don’t just file returns, we develop proactive strategies to minimize your tax burden and maximize your financial outcomes.

Trusted Nationwide

With offices in the Greater Toronto Area and Calgary, we provide expert tax services to clients across Canada confidently.

Our Calgary Office

Our CPA firm is located in Calgary and serves clients across the Alberta. We provide in-person meetings at our office and virtual consultations.

Address

50 Nolanridge Ct NW Unit 225, Calgary, AB T3R 2A8, Canada

Phone

Customers Reviews

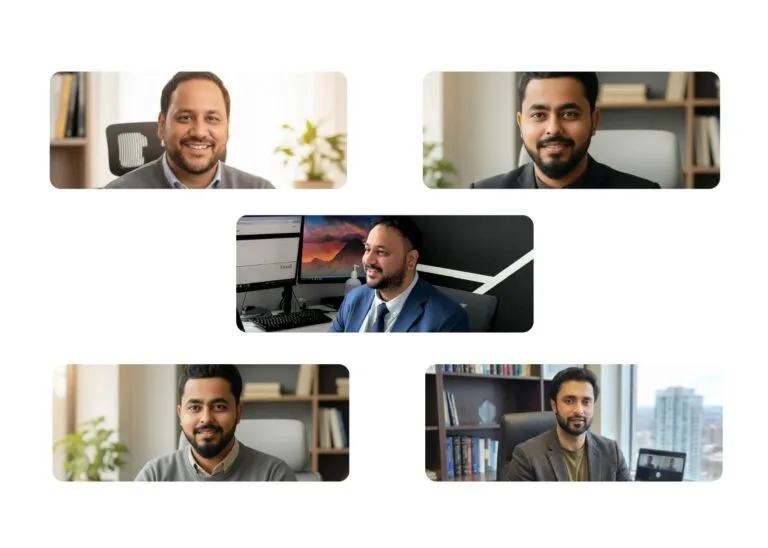

Meet Our Tax Professionals

Our team includes Chartered Professional Accountant and licensed CPA with years of hands-on experience. We track every tax law change to provide accurate guidance for individuals and businesses.

Waqar Naqvi, Ph.D., MFin, CFA

Tax Consultant

Narinder Singh, CPA, CGA

Head of Tax Planning, Corporate Structuring, and Corporate Taxes (T2)

Umar Khan, ACCA

Head of Bookkeeping US & Canada, Payroll, and HST

Got Any Questions?

Book a Free Meeting with Our Tax Experts

Take the first step toward better tax planning with a free consultation. Our team is ready to review your situation and provide clear guidance. Book a time slot directly on our calendar and we will connect with you shortly.