US Tax Accounting Services in Calgary

Our US tax accounting services in Calgary simplify cross-border tax obligations for individuals and businesses. We prepare US tax returns for American citizens living in Canada, Green Card holders, and Canadians with US income sources. Our U.S. tax accountants in Calgary ensure full compliance with IRS rules while optimizing foreign tax credits and treaty benefits to prevent double taxation.

CRA compliant process. Trusted nationwide.

Tax Return Filers LTD Delivers Strategic Tax Solutions in Calgary

Clients trust our proven approach. Each financial situation receives a custom tax strategy supported by deep expertise and attention to detail. Our 100% five star ratings across verified reviews reflect consistent client satisfaction and on time filings.

Trusted by 1,000+ Canadians

CPA Certified

QuickBooks

Certified Partner

Why Hire a U.S. Tax Accountant in Calgary?

US tax obligations are complex and filing errors trigger IRS penalties, double taxation, and compliance issues that are costly to resolve. A U.S. tax accountant in Calgary understands both Canadian and American tax systems and prevents mistakes that general accountants make on cross-border returns.

Our Calgary accountants specialize in US tax accounting services in Calgary for dual citizens, expats, and Canadians with American income or investments. We prepare IRS Form 1040, handle FBAR filings, claim foreign tax credits, and coordinate your US returns with Canadian T1 filings for consistent reporting.

Partnering with Tax Return Filers gives you access to CPAs who file with both CRA and IRS regularly. Clients receive year-round support, deadline tracking for both countries, and strategic advice that minimizes combined tax liability across both jurisdictions. Whether you need US tax returns in Calgary for personal compliance or business reporting, our team ensures accuracy and peace of mind.

Our Services in Calgary

Our Calgary team provides complete US tax accounting for individuals and businesses with American tax obligations. We handle IRS filings, FBAR reporting, state tax returns, and cross-border planning alongside your Canadian tax needs.

US Tax Return Preparation for Canadians

Canadians earning US income from employment, investments, rental properties, or business activities face IRS filing requirements. Our Calgary accounting firm handles complete US tax return preparation including Form 1040-NR for non-residents and applicable state returns.

We provide tax planning that minimizes your US tax burden through treaty benefits, foreign tax credits, and proper income allocation between countries. Our CPAs coordinate US preparation with your Canadian filings to ensure consistent reporting and eliminate double taxation.

US Tax Filing for American Citizens and Green Card Holders in Calgary

US citizens and green card holders living in Canada must file annual tax returns with the IRS regardless of where they earn income. Our Calgary CPAs prepare Form 1040, report worldwide income, and claim foreign tax credits that offset Canadian taxes paid.

We handle FBAR filings for foreign accounts exceeding $10,000 and FATCA reporting for specified foreign assets. Clients who missed prior filings receive support through IRS streamlined procedures to become compliant without facing harsh penalties.

Foreign Tax Credit Claims for US Filers

Foreign tax credits prevent US filers from paying tax twice on the same income earned in Canada. Our Calgary CPAs prepare IRS Form 1116 to claim credits for Canadian taxes paid on employment income, investment earnings, and business profits. We calculate eligible credits accurately and coordinate claims with your Canadian T1 return to maximize tax savings across both countries. Our US tax filing for American citizens and Green Card holders in Canada ensures you utilize every available mechanism to reduce your US tax liability.

US Business Tax Returns for Canadian Owners

Canadian business owners with US operations, subsidiaries, or income sources face complex IRS filing requirements. Our Calgary accountants prepare Form 1120 for US corporations, Form 1120-F for foreign corporations with US activities, and Form 5472 for reporting foreign ownership transactions.

We coordinate US business filings with your Canadian corporate returns to ensure compliance in both countries and minimize combined tax liability. Our US tax return preparation for Canadians covers all entity types including LLCs and partnerships requiring Form 1065.

Why Choose Tax Return Filers Ltd ?

Our team combines advanced academic credentials with decades of practical experience to deliver exceptional tax solutions tailored to your needs.

CRA-Compliant Experts

Our team includes CPA, ACCA, PhD-qualified professionals with specializations in cross-border, corporate, and personal taxation.

CRA Audit Defense

Successfully handled numerous CRA audits with expertise in Foreign Tax Credits, Section 216/116, and complex tax matters.

Strategic Tax Planning

We don’t just file returns, we develop proactive strategies to minimize your tax burden and maximize your financial outcomes.

Trusted Nationwide

With offices in the Greater Toronto Area and Calgary, we provide expert tax services to clients across Canada confidently.

Our Calgary Office

Our CPA firm is located in Calgary and serves clients across the Alberta. We provide in-person meetings at our office and virtual consultations.

Address

50 Nolanridge Ct NW Unit 225, Calgary, AB T3R 2A8, Canada

Phone

Customers Reviews

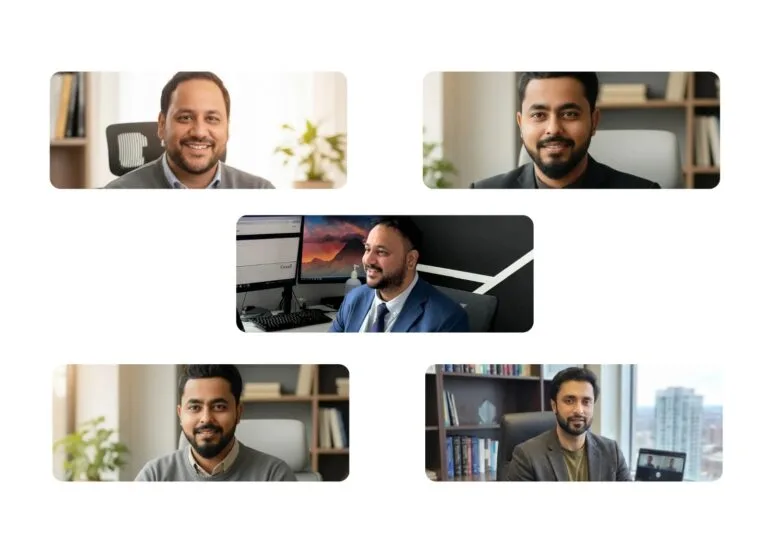

Meet Our Tax Professionals

Our team includes Chartered Professional Accountant and licensed CPA with years of hands-on experience. We track every tax law change to provide accurate guidance for individuals and businesses.

Waqar Naqvi, Ph.D., MFin, CFA

Tax Consultant

Narinder Singh, CPA, CGA

Head of Tax Planning, Corporate Structuring, and Corporate Taxes (T2)

Umar Khan, ACCA

Head of Bookkeeping US & Canada, Payroll, and HST

Got Any Questions?

Book a Free Meeting with Our Tax Experts

Take the first step toward better tax planning with a free consultation. Our team is ready to review your situation and provide clear guidance. Book a time slot directly on our calendar and we will connect with you shortly.