Corporate Tax Returns in Toronto

Corporations across Toronto require accurate tax filings that meet CRA deadlines and maximize available deductions. Our corporate tax return services handle T2 preparation, small business deduction optimization, and strategic tax planning for Canadian-controlled private corporations.

CRA compliant process. Trusted nationwide.

Tax Return Filers LTD Delivers Strategic Tax Solutions in Toronto

Clients trust our proven approach. Each financial situation receives a custom tax strategy supported by deep expertise and attention to detail. Our 100% five star ratings across verified reviews reflect consistent client satisfaction and on time filings.

Trusted by 1,000+ Canadians

CPA Certified

QuickBooks

Certified Partner

Why Hire a Corporate Tax Accountant in Toronto?

Corporate tax filings involve complex calculations, strict deadlines, and evolving CRA regulations that demand specialized expertise. A corporate tax accountant in Toronto identifies deductions, optimizes your tax position, and ensures accurate T2 returns that withstand CRA scrutiny.

Our Chartered Professional Accountant deliver corporate tax services in Toronto for Canadian-controlled private corporations, holding companies, and professional corporations across the city. We handle small business deduction optimization, capital cost allowance calculations, shareholder compensation planning, and quarterly installment management.

Partnering with Tax Return Filers connects your corporate tax filings with bookkeeping, payroll, and financial reporting under one roof. Toronto business owners gain year-round strategic advice, proactive tax planning, and responsive support from CPAs who understand their operations and growth objectives.

Solutions For Businesses

Our GTA accounting services cover tax preparation, bookkeeping, payroll, financial statements, audit and assurance, estate planning, and business incorporation.

Complete Corporate Tax Services in Toronto

Our corporate tax filing service covers every aspect of filing corporate taxes for Canadian-controlled private corporations, holding companies, and professional corporations. We manage the entire tax return preparation process from financial review to CRA submission.

As the best corporate tax accounting firm in Toronto, we handle T2 returns, corporate tax return filing, annual reports, and schedule preparations with precision. Our team calculates small business deductions, capital cost allowances, scientific research credits, and dividend tax integration to minimize your tax burden.

We serve startups, established businesses, and multi-entity corporate structures across Toronto and the GTA. Every corporation receives a dedicated accountant who understands your industry, tracks your filing deadlines, and delivers accurate returns on time.

Toronto Corporate Tax Filing

Our licensed Toronto CPA firm provides comprehensive corporate tax solutions for business owners throughout Toronto and the Greater Toronto Area. We streamline complex corporate filings through expert knowledge and efficient processes that save you time and reduce stress.

Corporate returns are submitted electronically for rapid CRA processing and instant confirmation of receipt. Clients access documents through our secure online portal with real-time status updates on every filing we prepare.

We maintain full compliance with federal and Ontario corporate tax requirements, track all filing deadlines, and organize records for future reference and CRA inquiries. Our team handles T2 preparation, installment calculations, and schedule completions with precision.

Toronto business owners rely on our firm for consistent accuracy, dependable service, and responsive communication throughout the year. We manage corporate taxation complexities so you concentrate on growing your business across Toronto.

Corporate Tax Services Solutions For Different Business Structures

Why Choose Tax Return Filers Ltd ?

Our team combines advanced academic credentials with decades of practical experience to deliver exceptional tax solutions tailored to your needs.

CRA-Compliant Experts

Our team includes CPA, ACCA, PhD-qualified professionals with specializations in cross-border, corporate, and personal taxation.

CRA Audit Defense

Successfully handled numerous CRA audits with expertise in Foreign Tax Credits, Section 216/116, and complex tax matters.

Strategic Tax Planning

We don’t just file returns, we develop proactive strategies to minimize your tax burden and maximize your financial outcomes.

Trusted Nationwide

With offices in the Greater Toronto Area and Calgary, we provide expert tax services to clients across Canada confidently.

Our Toronto Office

Our CPA firm is located in Toronto and serves clients across the Greater Toronto Area. We provide in-person meetings at our office and virtual consultations.

Address

19 Woodbine Downs Blvd #204, Toronto, ON M9W 6N5, Canada

Phone

Customers Reviews

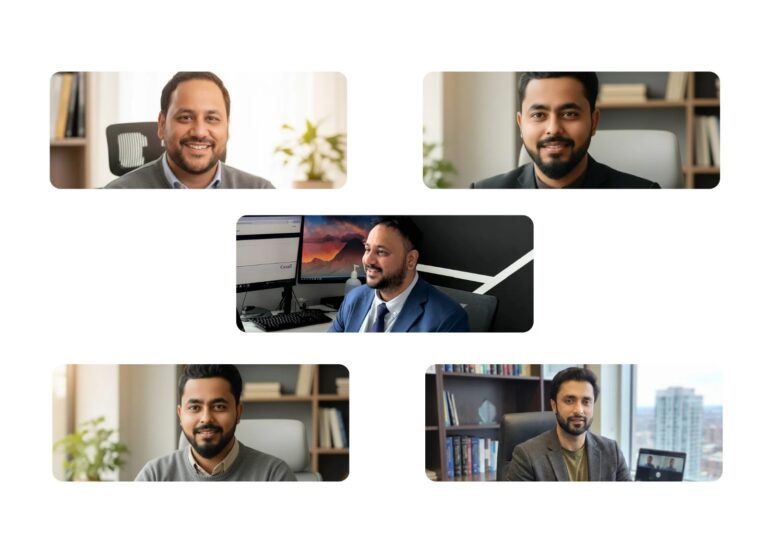

Meet Our Tax Professionals

Our team includes Chartered Professional Accountant and licensed CPA with years of hands-on experience. We track every tax law change to provide accurate guidance for individuals and businesses.

Waqar Naqvi, Ph.D., MFin, CFA

Tax Consultant

Narinder Singh, CPA, CGA

Head of Tax Planning, Corporate Structuring, and Corporate Taxes (T2)

Umar Khan, ACCA

Head of Bookkeeping US & Canada, Payroll, and HST

Got Any Questions?

Book a Free Meeting with Our Tax Experts

Take the first step toward better tax planning with a free consultation. Our team is ready to review your situation and provide clear guidance. Book a time slot directly on our calendar and we will connect with you shortly.