HST Return Filing Toronto

Registered businesses in Ontario must collect, track, and remit GST/PST/HST to CRA on taxable goods and services. Our Toronto accountants handle HST return preparation, input tax credit calculations, and timely electronic filing to avoid penalties and interest charges. We ensure accurate reporting and maximum credit recovery on every return submitted.

CRA compliant process. Trusted nationwide.

Tax Return Filers LTD Delivers Strategic Tax Solutions in Toronto

Clients trust our proven approach. Each financial situation receives a custom tax strategy supported by deep expertise and attention to detail. Our 100% five star ratings across verified reviews reflect consistent client satisfaction and on time filings.

Trusted by 1,000+ Canadians

CPA Certified

QuickBooks

Certified Partner

Why Hire a HST Accountant in Toronto?

HST filing errors trigger CRA audits, penalties, and interest charges that drain your resources and disrupt operations. A HST accountant in Toronto ensures accurate calculations, maximum input tax credit recovery, and timely submissions that keep your business compliant.

Our Chartered Professional Accountant provide HST preparation services Toronto businesses rely on for GST/HST registration, quarterly and annual return filing, input tax credit optimization, and quick method calculations. We track filing deadlines, reconcile your HST accounts, and identify credits many businesses overlook.

Toronto clients choose Tax Return Filers for reliable HST management that connects with their bookkeeping and corporate tax returns. You receive proactive deadline reminders, accurate filings submitted electronically to CRA, and responsive support for any HST inquiries or reassessments.

GST HST Filing Service Toronto

Toronto businesses receive complete GST HST filing services covering every requirement for accurate CRA submissions. We reconcile tax collected against input tax credits and prepare returns that recover maximum refunds or reduce your remittance amounts.

Our Chartered Professional Accountant handle annual, quarterly, and monthly HST Returns Toronto businesses need based on assigned reporting periods. Before each filing, we review your financial records to identify errors, capture overlooked credits, and verify every eligible business expense is claimed properly.

New businesses navigating HST registration receive clear guidance on collection obligations, documentation requirements, and CRA-assigned filing frequencies. Toronto businesses operating below the $30,000 threshold benefit from our voluntary registration services, allowing recovery of HST paid on startup costs and business expenses while presenting a professional image to commercial customers.

Related Services:

- GST/HST Registration and Account Setup

- Input Tax Credit Recovery

- Quick Method HST Calculations

- HST Audit Representation

- Voluntary HST Registration

- HST New Housing Rebate Applications

- GST/HST New Residential Rental Property Rebate

- Provincial Sales Tax Filings for Out-of-Province Sales

- HST Account Closure and Final Returns

- CRA HST Dispute Resolution

HST Registration for New Businesses in Toronto

Businesses in Ontario must register for HST once taxable revenues exceed $30,000 over four consecutive calendar quarters. Our Toronto team handles CRA registration, sets up your HST account, and advises on collection requirements and filing frequencies based on your projected sales.

New businesses receive guidance on invoicing requirements, record-keeping obligations, and input tax credit eligibility. We ensure your HST account is configured correctly from day one to avoid compliance issues and maximize credit recovery on startup expenses.

HST Audit Representation in Toronto

CRA audits HST accounts to verify reported sales, input tax credits, and compliance with collection requirements. Our Chartered Professional Accountant represent your business during audits, respond to CRA inquiries, organize records, and identify potential issues before CRA does. Clients receive professional representation that protects their interests and works toward the best possible outcome.

GST/HST Returns for Non-Residents in Toronto

Our Toronto tax services firm assists foreign businesses with Canadian tax registration, return preparation, and compliance with CRA requirements.

We advise non-resident vendors on marketplace rules, voluntary registration benefits, and input tax credit recovery. Our clients receive complete GST/HST support without needing a physical presence in Canada.

HST Reporting Periods and Filing Frequency in Toronto

CRA determines your HST reporting period based on annual taxable supplies generated by your business. Toronto businesses earning under $1.5 million file once per year, those with revenue between $1.5 million and $6 million submit quarterly returns, and businesses surpassing $6 million report monthly.

Revenue growth or fluctuations trigger changes to your assigned reporting period. CRA permits businesses to elect shorter reporting periods when faster input tax credit recovery benefits cash flow. We track your revenue thresholds, notify you when filing frequency adjustments become necessary, and process all changes with CRA to maintain your HST account in good standing.

Why Choose Tax Return Filers Ltd ?

Our team combines advanced academic credentials with decades of practical experience to deliver exceptional tax solutions tailored to your needs.

CRA-Compliant Experts

Our team includes CPA, ACCA, PhD-qualified professionals with specializations in cross-border, corporate, and personal taxation.

CRA Audit Defense

Successfully handled numerous CRA audits with expertise in Foreign Tax Credits, Section 216/116, and complex tax matters.

Strategic Tax Planning

We don’t just file returns, we develop proactive strategies to minimize your tax burden and maximize your financial outcomes.

Trusted Nationwide

With offices in the Greater Toronto Area and Calgary, we provide expert tax services to clients across Canada confidently.

Our Toronto Office

Our CPA firm is located in Toronto and serves clients across the Greater Toronto Area. We provide in-person meetings at our office and virtual consultations.

Address

19 Woodbine Downs Blvd #204, Toronto, ON M9W 6N5, Canada

Phone

Customers Reviews

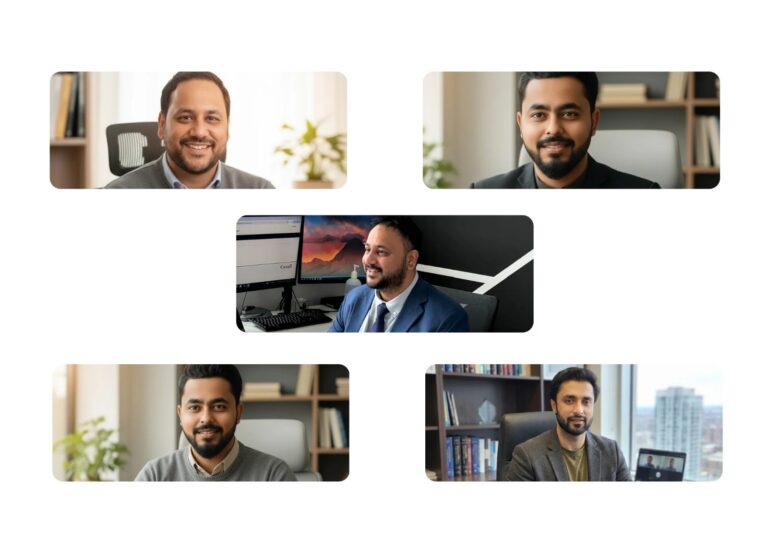

Meet Our Tax Professionals

Our team includes Chartered Professional Accountant and licensed CPA with years of hands-on experience. We track every tax law change to provide accurate guidance for individuals and businesses.

Waqar Naqvi, Ph.D., MFin, CFA

Tax Consultant

Narinder Singh, CPA, CGA

Head of Tax Planning, Corporate Structuring, and Corporate Taxes (T2)

Umar Khan, ACCA

Head of Bookkeeping US & Canada, Payroll, and HST

Got Any Questions?

Book a Free Meeting with Our Tax Experts

Take the first step toward better tax planning with a free consultation. Our team is ready to review your situation and provide clear guidance. Book a time slot directly on our calendar and we will connect with you shortly.