Professional Payroll Services in Toronto

Managing employee compensation requires accuracy, compliance, and timely remittances to avoid CRA penalties. Our Toronto payroll services handle pay calculations, CPP and EI deductions, income tax withholdings, T4 preparation, ROE filings, and source remittance submissions.

CRA compliant process. Trusted nationwide.

Tax Return Filers LTD Delivers Strategic Tax Solutions in Toronto

Clients trust our proven approach. Each financial situation receives a custom tax strategy supported by deep expertise and attention to detail. Our 100% five star ratings across verified reviews reflect consistent client satisfaction and on time filings.

Trusted by 1,000+ Canadians

CPA Certified

QuickBooks

Certified Partner

Why Hire a Payroll Provider in Toronto?

Processing payroll internally consumes valuable time and creates risk of calculation errors, missed deadlines, and CRA penalties. A payroll provider in Toronto ensures your employees are paid accurately and your business meets all federal and provincial remittance requirements.

Our Chartered Professional Accountant provide payroll tax services Toronto businesses depend on for weekly, bi-weekly, and monthly pay runs, CPP and EI calculations, income tax withholdings, T4 preparation, ROE filings, and source deduction remittances. We manage WSIB premiums, Employer Health Tax, and year-end reconciliations with precision.

Toronto clients choose Tax Return Filers for reliable payroll management integrated with bookkeeping and corporate tax services. You receive dedicated payroll specialists, automated deadline tracking, accurate employee payments every cycle, and complete compliance with CRA and provincial regulations.

Solutions For Businesses

Our GTA accounting services cover tax preparation, bookkeeping, payroll, financial statements, audit and assurance, estate planning, and business incorporation.

Complete Payroll Services in Toronto

Payroll Management and Integration Services Toronto

Our accounting firm Toronto integrates payroll services directly with CRA payroll accounts and leading accounting platforms including QuickBooks, Xero, and Sage. Automated gross-to-net calculations remove manual processing errors and maintain synchronized financial records across your entire system.

Records of Employment for departing employees are prepared and submitted electronically to Service Canada within required timeframes. Our Toronto team ensures full compliance with Ontario Employment Standards Act requirements, handles WSIB premium calculations and workplace classifications, and processes benefit deductions accurately each pay period.

Toronto clients receive customized payroll reports delivered bi-weekly detailing gross earnings, commissions, allowances, statutory deductions, and net payments. Our direct deposit processing guarantees your employees receive accurate payments on schedule through secure electronic transfers to their bank accounts.

Payroll Account Services For Businesses in Toronto

Our payroll accounting services deliver complete payroll management for small business owners across Toronto. We handle wage calculations, benefit deductions, tax withholdings, and CRA remittances while maintaining accurate records that integrate with your bookkeeping and financial statements.

Every pay cycle includes detailed payroll statements for your business showing gross wages, deductions, employer contributions, and net payments. These statements provide clear documentation for your records, support financial reporting, and simplify year-end tax preparation.

Payroll Services in Toronto for Companies of All Sizes

Our Toronto payroll services support startups processing their first hires, growing companies adding staff monthly, and established enterprises managing large workforces across multiple locations. We customize payroll solutions for Toronto businesses need based on employee count, pay frequency, and compensation complexity including hourly wages, salaried positions, commission structures, and performance bonuses.

Federal and Ontario payroll regulations change frequently, and non-compliance triggers CRA penalties, interest charges, and employee disputes. Our Chartered Professional Accountant providing payroll services in Toronto monitor Employment Standards Act amendments, minimum wage adjustments, overtime calculation rules, and statutory holiday entitlements throughout the year.

Why Choose Tax Return Filers Ltd ?

Our team combines advanced academic credentials with decades of practical experience to deliver exceptional tax solutions tailored to your needs.

CRA-Compliant Experts

Our team includes CPA, ACCA, PhD-qualified professionals with specializations in cross-border, corporate, and personal taxation.

CRA Audit Defense

Successfully handled numerous CRA audits with expertise in Foreign Tax Credits, Section 216/116, and complex tax matters.

Strategic Tax Planning

We don’t just file returns, we develop proactive strategies to minimize your tax burden and maximize your financial outcomes.

Trusted Nationwide

With offices in the Greater Toronto Area and Calgary, we provide expert tax services to clients across Canada confidently.

Our Toronto Office

Our CPA firm is located in Toronto and serves clients across the Greater Toronto Area. We provide in-person meetings at our office and virtual consultations.

Address

19 Woodbine Downs Blvd #204, Toronto, ON M9W 6N5, Canada

Phone

Customers Reviews

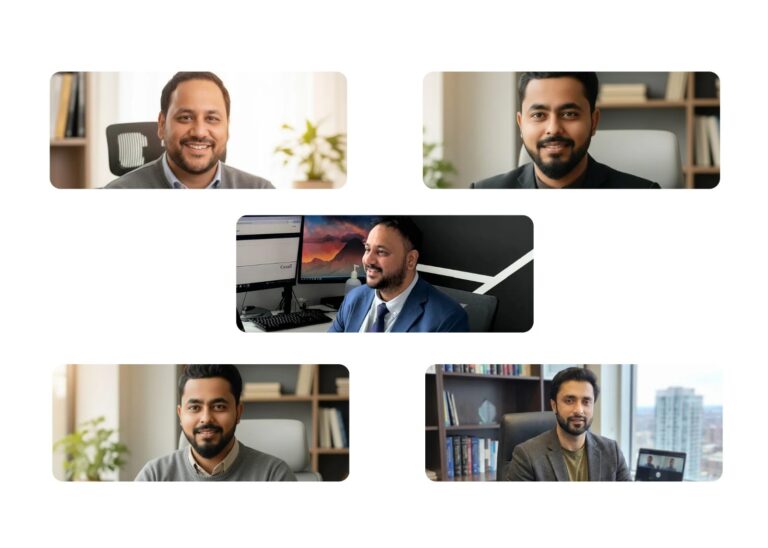

Meet Our Tax Professionals

Our team includes Chartered Professional Accountant and licensed CPA with years of hands-on experience. We track every tax law change to provide accurate guidance for individuals and businesses.

Waqar Naqvi, Ph.D., MFin, CFA

Tax Consultant

Narinder Singh, CPA, CGA

Head of Tax Planning, Corporate Structuring, and Corporate Taxes (T2)

Umar Khan, ACCA

Head of Bookkeeping US & Canada, Payroll, and HST

Got Any Questions?

Book a Free Meeting with Our Tax Experts

Take the first step toward better tax planning with a free consultation. Our team is ready to review your situation and provide clear guidance. Book a time slot directly on our calendar and we will connect with you shortly.