Professional Tax Accountant Firm in Brampton

Our CPA firm delivers complete tax and accounting solutions for individuals and businesses in Brampton. The tax accountants at our Brampton accounting firm bring years of hands-on experience in personal tax returns, corporate filings, bookkeeping, and financial planning. We provide accurate, dependable support to clients throughout Brampton and the Greater Toronto Area.

CRA compliant process. Trusted nationwide.

Tax Return Filers LTD Delivers Strategic Tax Solutions in Brampton

Clients trust our proven approach. Each financial situation receives a custom tax strategy supported by deep expertise and attention to detail. Our 100% five star ratings across verified reviews reflect consistent client satisfaction and on time filings.

Trusted by 1,000+ Canadians

CPA Certified

QuickBooks

Certified Partner

Why Hire an Accounting Firm in Brampton?

A professional accounting firm in Brampton delivers expert financial guidance that in-house management often lacks. Lenders review your tax records before they approve loans, potential partners assess your financial health before they commit, and CRA expects accurate filings that meet strict deadlines.

Without qualified accounting support, your business risks costly errors, missed deductions, and compliance issues.

Brampton businesses and individuals select our accounting and tax services for precise, timely solutions from experienced CPA. When you partner with Tax Return Filers, you gain a dedicated accounting team that works alongside your existing financial records. We ensure consistent bookkeeping, optimized tax returns, and strategic advice that supports your personal and business financial goals.

Accounting Services in Brampton

Our Brampton accounting firm provides complete tax and accounting solutions for individuals and businesses. We prepare personal income tax returns, file corporate taxes, and handle cross-border filings for non-residents and international clients.

Our Brampton Office

Our CPA firm is located in Brampton and serves clients across the Greater Toronto Area. We provide in-person meetings at our office and virtual consultations.

Address

23 Sapwood Cres, Brampton, ON L6Z 0K8, Canada

Phone

Customers Reviews

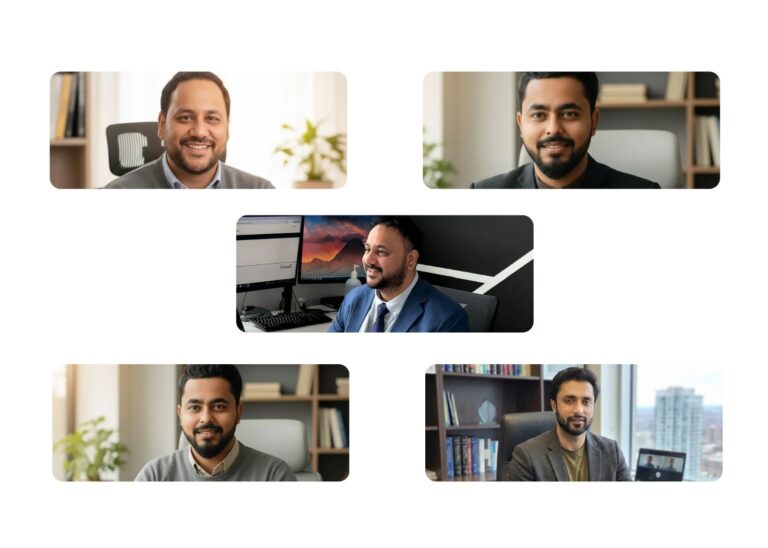

Meet Our Tax Professionals

Our team includes Chartered Professional Accountant and licensed CPA with years of hands-on experience. We track every tax law change to provide accurate guidance for individuals and businesses.

Waqar Naqvi, Ph.D., MFin, CFA

Tax Consultant

Narinder Singh, CPA, CGA

Head of Tax Planning, Corporate Structuring, and Corporate Taxes (T2)

Umar Khan, ACCA

Head of Bookkeeping US & Canada, Payroll, and HST

Why Choose Tax Return Filers Ltd ?

Our team combines advanced academic credentials with decades of practical experience to deliver exceptional tax solutions tailored to your needs.

CRA-Compliant Experts

Our team includes CPA, ACCA, PhD-qualified professionals with specializations in cross-border, corporate, and personal taxation.

CRA Audit Defense

Successfully handled numerous CRA audits with expertise in Foreign Tax Credits, Section 216/116, and complex tax matters.

Strategic Tax Planning

We don’t just file returns, we develop proactive strategies to minimize your tax burden and maximize your financial outcomes.

Trusted Nationwide

With offices in the Greater Toronto Area and Calgary, we provide expert tax services to clients across Canada confidently.

Complete Accounting Services in Brampton

Personalized Solutions for Every Client in Brampton

Every client has distinct financial goals and unique tax circumstances. Our Brampton accounting firm dedicates time to understand your specific needs before we develop a customized plan. We work with salaried employees, self-employed professionals, real estate investors, and business owners throughout the city.

Our tax accountants serve clients in Bramalea, Heart Lake, Springdale, Mount Pleasant, Castlemore, and Downtown Brampton. Local restaurant owners, medical professionals, doctors, lawyers, entrepreneurs, IT consultants, construction contractors, trucking company owners, and retail shop operators trust us with their accounting and tax needs.

We provide one-on-one consultations at our Brampton office or through virtual meetings. Our CPA assess your complete financial picture and deliver solutions that reduce your tax liability and maintain full compliance with CRA requirements.

We Handle Complex Tax Situations

Our tax professionals manage situations that extend beyond standard filings in Brampton. We work with clients who face unfiled returns, CRA audits, back taxes, voluntary disclosures, and reassessment appeals. Our team prepares T1 adjustments, T2 corporate returns, T3 trust returns, and T5013 partnership filings with precision.

We assist business owners with SR&ED tax credits, capital cost allowance optimization, and shareholder loan compliance under Section 15. Real estate investors rely on us for principal residence exemptions, Section 45 elections, and GST/HST new housing rebates. Our CPA resolve complex matters related to foreign income reporting, T1135 declarations, and treaty-based tax positions.

Clients who face payroll remittance penalties, director liability assessments, or installment interest charges come to us for resolution. We communicate directly with CRA on your behalf, submit all required documentation, and work to reduce penalties and interest to the minimum.

Your Source for Accounting Services in Brampton

Our professional accounting firm in Brampton has built a solid reputation for accurate financial solutions to individuals and businesses. Clients across Brampton and the Greater Toronto Area rely on our team for year-round accounting support that extends beyond tax season.

We started with a simple goal to make accounting in Brampton accessible, transparent, and results-driven. Today, we serve hundreds of clients from first-time tax filers to established corporations with complex financial structures. Our firm handles bookkeeping, payroll, financial reporting, tax planning, and CRA representation under one roof.

Every member of our team holds credentials from recognized accounting bodies and brings hands-on experience across multiple industries. We invest in continuous training and updated software to deliver fast, error-free results. Our accounting services in Brampton save you time, reduce your tax liability, and give you complete visibility into your financial position.

Registered with Chartered Professional Accountants of Ontario

Our firm holds registration with Chartered Professional Accountant of Ontario. This credential verifies that our team satisfies strict education, examination, and ethical requirements set by CPA Ontario.

Clients who search for the best accountant near me in Brampton discover a team that operates under complete regulatory oversight. Every tax professional at our firm adheres to CPA Ontario guidelines for accuracy, confidentiality, and professional conduct.

As a trusted personal tax services provider, we maintain the highest standards in every client relationship. Our dedication to compliance and integrity has built our reputation as the best tax practice firm for individuals and businesses throughout Brampton and the Greater Toronto Area.

Got Any Questions?

Book a Free Meeting with Our Tax Experts

Take the first step toward better tax planning with a free consultation. Our team is ready to review your situation and provide clear guidance. Book a time slot directly on our calendar and we will connect with you shortly.

01

Toronto

19 Woodbine Downs Blvd #204, Toronto, ON M9W 6N5, Canada

02

Mississauga

4 Robert Speck Pkwy #1553, Mississauga, ON L4Z 1S1, Canada

03

Calgary

50 Nolanridge Ct NW Unit 225, Calgary, AB T3R 2A8, Canada

04

Brampton

23 Sapwood Cres, Brampton, ON L6Z 0K8, Canada